To err is human and we tend to forget that, up until recently, most of the population of the Western world was illiterate. Learning languages was the sign of a privileged education and translating texts was a task accomplished by a select few for a very small audience — leading to blunders that are still perpetuated today. Here are a few examples:

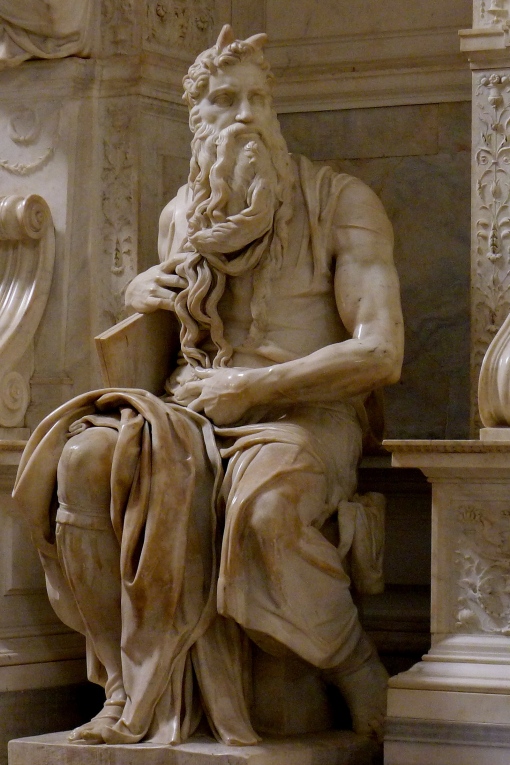

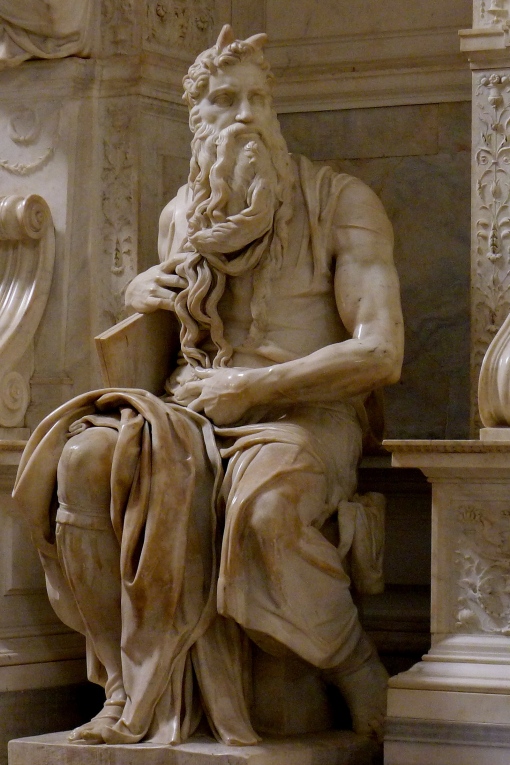

Horned Prophet

According to the Torah, when Prophet Moses descends from Mount Sinai bearing the ten commandments, he is glowing with karan, “radiance.” But written Hebrew has no vowels, and St. Jerome, the patron saint of translators who learned Hebrew to translate the Bible into Latin, confused karan with keren and turned radiant Moses into a horned one. So with one typo the man gained horns, a representation that can be found in Michelangelo’s Moses, for instance.

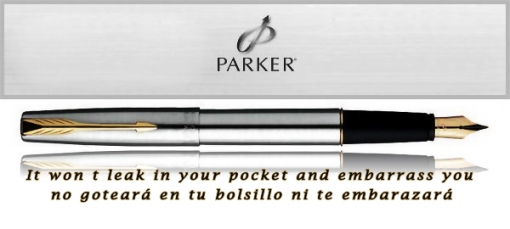

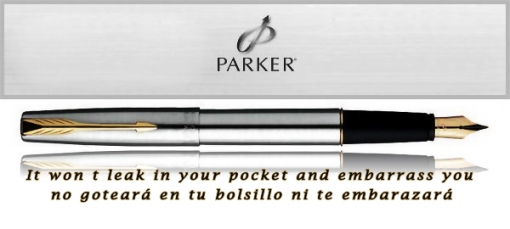

Pen is mightier than penis

Branding is serious business and one bad translation is enough to make a product fail. When American Parker Pen expanded into Mexico, its slogan read, “It won’t leak in your pocket and embarrass you.” But the verb to embarrass was confused with embarazada, a false cognate in Spanish, meaning to impregnate. So, the product was promoted with the translation, “It won’t leak in your pocket and make you pregnant.”

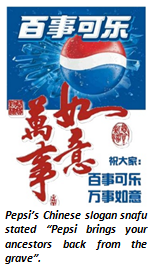

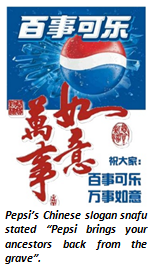

Necromantic Pepsi

In the 1960s, Pepsi’s slogan, “Come Alive With the Pepsi Generation,” arrived in Taiwan China to very negative responses. The reason? In Chinese, the slogan translates to “Pepsi brings your relatives back from the dead.”

Coked Tadpoles

When Coca-Cola first decided to market its brand in China, it was met with an unusual problem – many of the Chinese characters that best represented the sounds in “Coca-Cola” had meanings that didn’t work at all. Two of the most famous phonetic matches (which may have been coined by local Chinese shopkeepers working on their own) translated to the reader as “Female horse stuffed with wax” and “Bite the wax tadpole,” both of which were unworkable, for obvious reasons. Coca-Cola had to do some meticulous research before it jumped into the Chinese market. The company apparently researched around 40,000 Chinese characters before coming to the conclusion of using one that simply meant “Happiness in the mouth”—it’s not perfect, but at least it’s better than a wax tadpole.

Delicious Fingers

We all love Colonel Harland Sanders for one thing … and it’s fried with a blend of seven secret herbs and spices. In fact, did you know that a bucket of the Colonel’s chicken is a Christmas tradition in Japan? But it’s said that KFC got off on the wrong foot when it decided to introduce its brand to the Chinese market in the early 1980s. Legend has it that when KFC opened its doors in Beijing, the franchise accidentally mistranslated their slogan, which gave it a whole new, decidedly unappetizing meaning: somewhere in the translation process, “Finger-lickin’ good” had become “Eat your fingers off,” which, as you can imagine, didn’t sit too well with the local crowd.

Holy Papa

When the Holy Father planned a trip to Miami, a local T-shirt manufacturer came up with the splendid idea of designing commemorative T-shirts for the Spanish-speaking market for the special occasion. Although the intent was good, the message came across as somewhat demeaning for the Pope. I mean, let’s face it, who would like being called a potato? Which is exactly what the T-shirts allegedly read: “I saw the potato.” To be fair, it was an honest mistake, since the Pope is known as “el Papa” in Spanish, and not “La Papa,” as was printed on the T-shirts, which means “the potato.”

Skin Flying

Braniff Airlines decided to add a little extra to the luxury class flights it offered by including comfy leather seats, but what the airline didn’t realize is that marketing a new service to a foreign crowd is often more tricky than it sounds. Braniff decided to go with the slogan “Fly in Leather” which sounded pretty good, until it was translated to the local languages of the Hispanic and Latin America markets, where it read, “Vuela en cuero,” which meant “Fly in Leather” in English, but could also be easily be mistaken for “Vuela en cueros” which meant “Fly Naked.” Not a great way to promote first-class seats, much to the disappointment of middle-aged business travelers, who seemed to be looking forward to, well … a little something extra.

Lazy bankers

In 2009, HSBC bank scrambled to fix a $10 million rebranding campaign after their catchphrase “Assume Nothing” was mistranslated as “Do Nothing” in various countries.

Cold burial

Nikita Kruschev infamously concluded a Cold-War-era speech with a threat directed at America: “We will bury you!” Needless to say, this blood-thirsty statement whipped up American fear and outrage. But the true translation of his words is more like, “we will be present when you are buried,” which is a common Russian phrase meaning, essentially, “we will outlast you.”

False friends

According to interpreter John Coleman-Holmes in his book Mâcher du Coton, a Spanish delegate once apologized to the other delegates at a conference for having a cold: “Estoy constipado, perdóname!” But his Spanish was rendered into French as, “I am constipated, please excuse me!” The interpreter attempted a swift explanation, but was only met with laughter and ridicule.

New Zealand Treaty

Signing agreements is serious business, especially if you’re signing a bad translation. When the Maori chiefs signed the Waitangi Treaty with the English, it was imperfectly translated into the Maori language, stating the natives would have control over their territory but would surrender governance to the English, maintaining authority and control over their land. The English version, however, demanded a surrender of sovereignty in all of its rights and powers. So New Zealand became a colony instead of an independent land.

Holland King

Lodewijk Napoleon was crowned king of Holland in 1806 by his brother, Napoleon Bonaparte. Eager to please his people and to be loved by the general population, he changed his name from Ludovic to Lodewijk and declared himself Dutch rather than French. His language skills, however, were initially so poor he ended up declaring himself the “Rabbit of ‘Olland” (“Konijn van ‘Olland”) instead of “King of Holland” (“Koning van Holland”).

Pervert President

When US President Jimmy Carter traveled to Poland in 1977 for a news conference, he was subjected to a succession of verbal faux pas. The interpreter responsible for conveying the President’s English into Polish mangled his words, using the occasional Russian term and abusing the Polish language. When the President mentioned he had left the US that morning, the interpreter stated he had left the country never to return. To add insult to injury, the President’s desire to “come to learn your opinions and understand your desires for the future” was rendered erotically as a strong lust to “get to know the Poles carnally.” Last but not least, when Carter stated how happy he was to be in Poland, it was translated as “he was happy to grasp Poland’s private parts”. Things didn’t get much better when the replacement interpreter sat silently while the President spoke. Apparently he could not understand Jimmy Carter’s southern accent and chose not to speak, for fear of committing further diplomatic sins.

Laughter is a must

In 1981, while giving a speech to a small Methodist college in Japan, President Carter opened with a joke. The interpreter spoke to the crowd, and the audience immediately erupted into laughter. Surprised by the joke’s success, Carter asked the interpreter how he’d managed to elicit such a reaction. The interpreter reluctantly admitted that he had said, “President Carter told a funny story. Everyone must laugh.”

Kill Russians

Players of “Call of Duty: Modern Warfare 2” in Japan were gunned down by an unusual translation error. According to the American version of the game, one comment which was made by the leading character clearly states “Remember, no Russian.” A simple and understandable line for the English speaking crowd for them no to speak Russian, but the Japanese translation read, “Kill them, they are Russians.” What happened next? The Japanese players did just what they were told and started killing every Russian character they encountered.